In this blogpost, you will receive small insides into the accounting work of eXpand. Two times a term, we do a Controlling Report, where we have a look at our revenues, expenses, investments and our profit/loss. Additionally, we show some crucial key figures. In this blogpost, we will show you some vital issues about our last Controlling Reports of October and November 2022.

Turnover and its development and receivables

We are pretty satisfied with the revenue of the last months. In October 2022, we have achieved a turnover of about € 63.500 followed by a low-turnover-month in November of about € 13.600. But in comparison to the revenues of October and November 2021, we achieved nearly the same amount of revenues in sum. Our most successful category is consulting services, which has always been the most essential category in our practice enterprise. About 60% of the revenues this year are consulting services, about 17% market analysis and 23% of our revenues were categorized in digital transformation.

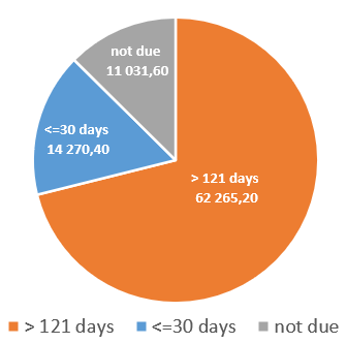

Since we are doing a double-entry accounting, we have to different between paid and outstanding incoming payments. Unfortunately, we have a big amount of receivables. At the end of November, our receivables were € 84.106,40. 74% of them are outstanding for more than 121 days. At the chart you can see a division of our receivables.

Expenses and Result

Until the end of November 2022, we recorded a total of expenses of about € 160.150. About 80% of the total expenses are personal costs. The remaining expenses are taxes, marketing expenses, depreciation and other overheads.

The numbers above result a profit of € 15.262 from January to November 2022, while we achieved a profit of about € 51.400 in October and a loss of € 6.000 in November. The loss of November is mainly due to the double salaries and the low revenues.

Crucial key figures

- Equity Ratio: 86,32%

- Return on Investment: 19,32%

- Return on Sales: 18,44%